Weekly Market Report

For Week Ending June 4, 2022

For Week Ending June 4, 2022

The slowdown in the U.S. housing market is causing lumber prices to plummet. Nationally, lumber prices fell 12% the week ending June 3 and are down 47% year-to-date, representing a 65% decline from 2021’s record high of $1,733 per thousand board feet, according to the National Association of Home Builders (NAHB). That could be good news for prospective homebuyers, who have watched lumber prices skyrocket during the pandemic, adding more than $18,600 to the average price of a new single-family home in the past year.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 4:

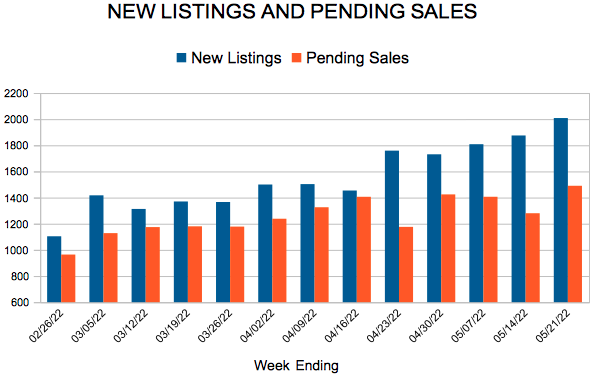

- New Listings decreased 2.1% to 1,772

- Pending Sales decreased 13.7% to 1,077

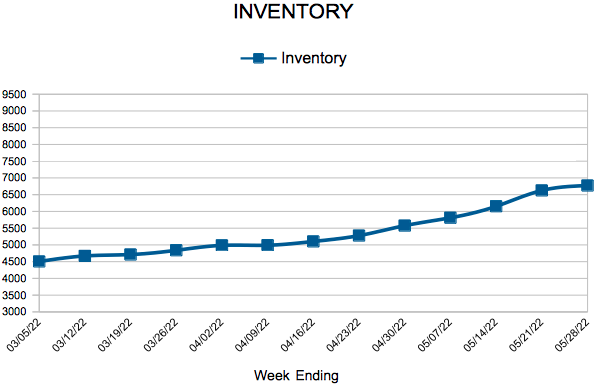

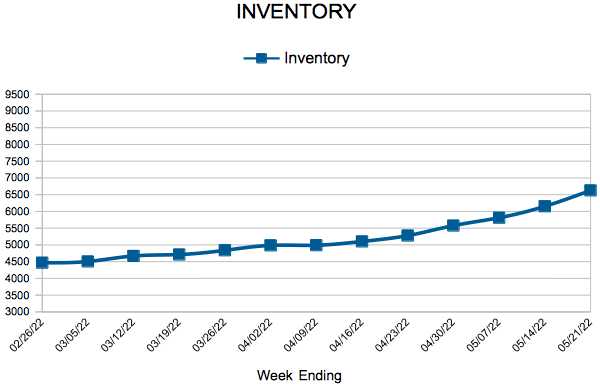

- Inventory increased 7.9% to 6,968

FOR THE MONTH OF APRIL:

- Median Sales Price increased 10.0% to $370,000

- Days on Market decreased 9.7% to 28

- Percent of Original List Price Received increased 0.5% to 103.8%

- Months Supply of Homes For Sale increased 9.1% to 1.2

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

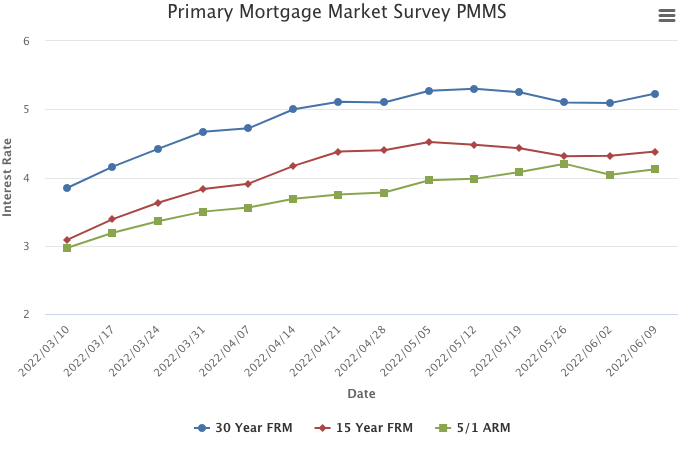

Mortgage Rates Increase

June 9, 2022

After little movement the last few weeks, mortgage rates rose again on the back of increased economic activity and incoming inflation data. The housing market is incredibly rate-sensitive, so as mortgage rates increase suddenly, demand again is pulling back. The material decline in purchase activity, combined with the rising supply of homes for sale, will cause a deceleration in price growth to more normal levels, providing some relief for buyers still interested in purchasing a home.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending May 28, 2022

For Week Ending May 28, 2022

Nationally, home sales and contract signings continue to soften compared to last year’s pace, while sellers are working quickly to list their homes and cash in on the remaining buyer demand. Realtor.com reports new listings are growing nearly twice as fast nationwide in May compared to this time a year ago, leading to a greater availability of homes for sale. As inventory inches upward and competition eases, sellers are having to adjust to the shifting landscape, with an increase in price reductions reported across many markets.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 28:

- New Listings increased 0.1% at 1,608

- Pending Sales decreased 15.4% to 1,451

- Inventory increased 4.6% to 6,772

FOR THE MONTH OF APRIL:

- Median Sales Price increased 10.0% to $370,000

- Days on Market decreased 9.7% to 28

- Percent of Original List Price Received increased 0.5% to 103.8%

- Months Supply of Homes For Sale remained flat at 1.1

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

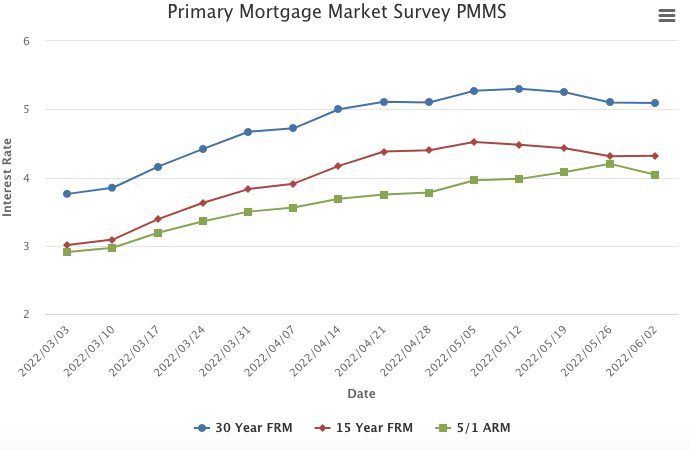

Mortgage Rates Stay Relatively Flat

June 2, 2022

Mortgage rates continued to inch downward this week but are still significantly higher than last year, affecting affordability and purchase demand. Heading into the summer, the potential homebuyer pool has shrunk, supply is on the rise and the housing market is normalizing. This is welcome news following unprecedented market tightness over the last couple years.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending May 21, 2022

For Week Ending May 21, 2022

Rental prices continue to soar to new highs, with the median rent reaching $1,827 as of last measure, a 16.7% increase from the same time last year, according to Realtor.com. Rental units are in short supply and demand remains high, with real estate professionals reporting a surge in rental inquiries, applications, and showing activity across the nation. Bidding wars are becoming increasingly common in many rental home markets, causing some properties to rent for substantially over asking price.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 21:

- New Listings increased 3.4% to 2,008

- Pending Sales decreased 8.7% to 1,490

- Inventory increased 2.9% to 6,626

FOR THE MONTH OF APRIL:

- Median Sales Price increased 10.0% to $370,000

- Days on Market decreased 9.7% to 28

- Percent of Original List Price Received increased 0.5% to 103.8%

- Months Supply of Homes For Sale remained flat at 1.1

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 76

- 77

- 78

- 79

- 80

- …

- 108

- Next Page »