For Week Ending April 23, 2022

For Week Ending April 23, 2022

Home sales prices continue to reach new heights, and record gains in equity are motivating an increasing number of sellers to put their homes up for sale, according to Homelight’s 2022 Buyer and Seller Insights Report. With multiple offers common in many markets, many homeowners have high expectations when it comes to the sale of their home. More than 40% of sellers believe their home will sell for more than asking price, and about half of those surveyed expect to retain 30% or more of the sale price as a profit.

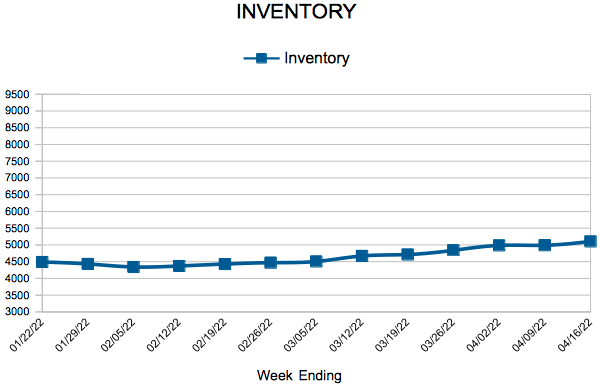

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 23:

- New Listings decreased 0.6% to 1,759

- Pending Sales decreased 22.8% to 1,176

- Inventory decreased 10.9% to 5,278

FOR THE MONTH OF MARCH:

- Median Sales Price increased 7.8% to $354,000

- Days on Market decreased 10.3% to 35

- Percent of Original List Price Received increased 0.8% to 102.7%

- Months Supply of Homes For Sale remained flat at 1.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending April 16, 2022

For Week Ending April 16, 2022

Builder confidence softened for the fourth straight month in April, according to the National Association of Home Builders/Wells Fargo Housing Market Index, as escalating sales prices, higher construction costs, and increasing mortgage rates continue to impact housing affordability. With the average sales price of a new home upwards of $500,000 as of last measure, builders report sales traffic and sales conditions have fallen to their lowest points since last summer.

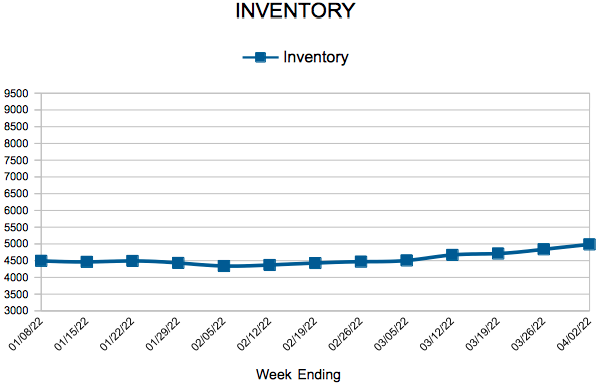

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 16:

- New Listings decreased 12.8% to 1,454

- Pending Sales decreased 6.3% to 1,406

- Inventory decreased 13.2% to 5,103

FOR THE MONTH OF MARCH:

- Median Sales Price increased 7.8% to $354,000

- Days on Market decreased 10.3% to 35

- Percent of Original List Price Received increased 0.8% to 102.7%

- Months Supply of Homes For Sale remained flat at 1.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending April 9, 2022

For Week Ending April 9, 2022

Rising mortgage interest rates are taking a toll on borrowers, having increased more than 1.5 points since the beginning of the year, the fastest three-month rate increase since 1994, according to Freddie Mac. The recent surge in mortgage rates has caused a decline in mortgage demand, with the Mortgage Bankers Association (MBA) reporting the Refinance Index is down 62% compared to a year ago, while the unadjusted Purchase Index is 6% lower compared to this time last year.

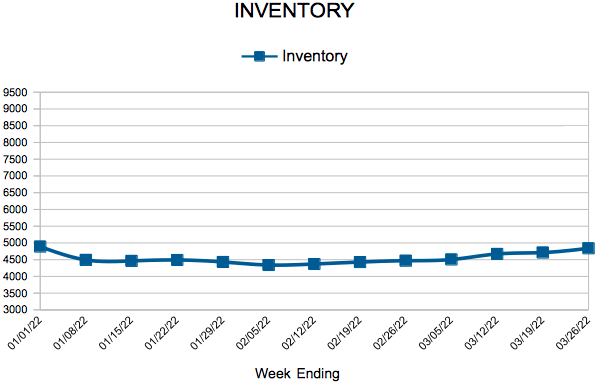

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 9:

- New Listings decreased 13.8% to 1,503

- Pending Sales increased 3.3% to 1,326

- Inventory decreased 12.1% to 4,990

FOR THE MONTH OF MARCH:

- Median Sales Price increased 7.8% to $353,950

- Days on Market decreased 10.3% to 35

- Percent of Original List Price Received increased 0.8% to 102.7%

- Months Supply of Homes For Sale remained flat at 1.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending April 2, 2022

For Week Ending April 2, 2022

The median national home price recently hit a new all-time high of $405,000 in March, a 13.5% increase annually, according to Realtor.com’s latest Monthly Housing Trends Report. As home prices continue to rise, the share of homes experiencing price reductions has also grown, with 25 of the 50 largest metro areas reporting an increase in price reductions last month, up from 18 in February, which may be an early sign the housing market is moderating somewhat.

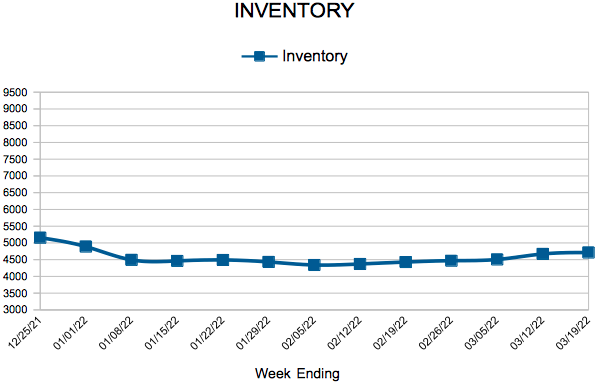

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 2:

- New Listings increased 0.2% to 1,500

- Pending Sales decreased 11.4% to 1,238

- Inventory decreased 11.8% to 4,986

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 8.3% to $340,000

- Days on Market decreased 4.3% to 44

- Percent of Original List Price Received increased 0.7% to 100.8%

- Months Supply of Homes For Sale decreased 10.0% to 0.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending March 26, 2022

For Week Ending March 26, 2022

Mortgage rates have surged recently, jumping to 4.42% the week ending March 24, up more than a quarter of a percentage point compared to the previous week, Freddie Mac reports. Rates have increased 1.2% since January and are at the highest level in more than 3 years, with the typical homebuyer now spending $250 more per month to purchase a home, according to the National Association of REALTORS®.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 26:

- New Listings decreased 12.8% to 1,366

- Pending Sales decreased 12.8% to 1,178

- Inventory decreased 13.7% to 4,839

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 8.3% to $340,000

- Days on Market decreased 4.3% to 44

- Percent of Original List Price Received increased 0.7% to 100.8%

- Months Supply of Homes For Sale decreased 10.0% to 0.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

- « Previous Page

- 1

- …

- 35

- 36

- 37

- 38

- 39

- …

- 52

- Next Page »