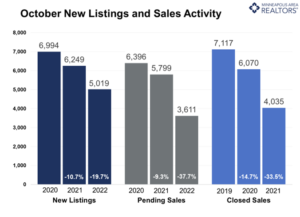

- Buyer activity dropped 37.7 percent with 3,611 pending sales

- Median sales price of Twin Cities homes rose 4.7 percent to $356,002

- 30-Year mortgage rates are averaging around 7.0 percent, the highest since 2002

(November 15, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, pending sales were down by over a third in October compared to last year. The decline in buyer activity is largely a response to increased mortgage interest rates and many completing purchases in the last couple years. Meanwhile, home prices continue their ascent.

SALES & LISTINGS

Several rate hikes by the Federal Reserve have had their desired effect: to slow borrowing activity and slow the demand for capital. This has significantly cooled home sales activity across the nation, including in the Twin Cities. In October, buyers saw their mortgage interest rates increase to 7.1 percent, a 20-year record. Facing higher monthly payments (about 35.0 percent higher), buyers were reluctant to sign contracts. Pending sales fell 37.7 percent to 3,611 purchase agreements and 4,035 transactions closed, down 33.5 percent. The Twin Cities has not seen a year-over-year decline in demand this substantial since the summer of 2010.

“We quickly forget how the last two years were extraordinary and historic years for housing. There will always be a lull after that. But these rates are exacerbating this,” according to Denise Mazone, President of Minneapolis Area REALTORS®. “The reality is that this is a more typical market but doesn’t feel that way compared to the last few years. Sellers getting 104.0% of their list price in 4 hours with 40 offers is neither normal nor sustainable.”

Seller activity was also down as many hesitated to become buyers and trade in their favorable rates for higher payments. Softer demand has meant homes spend more time on the market—36 days on average or nine days longer than last October but one day longer than 2020. Sellers listed 5,019 properties on the market, 19.7 percent fewer than this time in 2021. Those that did list tended to accept a smaller share of their asking price, averaging 98.2 percent of list price.

INVENTORY & HOME PRICES

The median home price in the Twin Cities increased by 4.7 percent to $356,002. While up, the increase is down from some double-digit price gains in 2020 and 2021. In fact, it’s the smallest increase since the onset of the pandemic. Although the rate of price growth is slowing, prices continue rising as both the homes and buyers in the market skew toward higher price points. Inventory levels remain tight despite the recent shifts toward a more balanced market. The softening in demand has been met with a similar decline in new listings, keeping the balance relatively tight.

“Between changing rates, inflation, an election and a possible recession, there’s a lot of uncertainty in the air right now,” said Mark Mason, President of the Saint Paul Area Association of REALTORS®. “Despite all that, our region still has thousands of eager buyers every month searching for their next home.” October ended with 8,756 homes for sale, 5.1 percent more than last year. Weaker buyer activity has shifted our industry back towards a more balanced marketplace (4-6 months of supply), but buyers should understand we are still in a seller’s market. Month’s supply of inventory rose 26.7 percent to 1.9 months.

LOCATION & PROPERTY TYPE

Market activity varies by area, price point and property type. New home sales fell 18.3 percent while existing home sales were down 33.8 percent. Single family sales fell 32.2 percent, condo sales declined 36.4 percent and townhome sales were down 33.1 percent. Sales in Minneapolis decreased 30.0 percent while Saint Paul sales fell 33.4 percent. Cities like Corcoran, Elko New Market, St. Paul Park and Belle Plaine saw the largest sales gains while Princeton, Centerville, East Bethel and North St. Paul all had notably lower demand than last year.

For more information on weekly and monthly housing numbers visit www.mplsrealtor.com or www.spaar.com

OCTOBER 2022 HOUSING TAKEAWAYS (COMPARED TO A YEAR AGO)

- Sellers listed 5,019 properties on the market, a 19.7 percent decrease from last October

- Buyers signed 3,611 purchase agreements, down 37.7 percent (4,035 closed sales, down 33.5 percent)

- Inventory levels grew 5.1 percent to 8,756 units

- Month’s Supply of Inventory rose 26.7 percent to 1.9 months (4-6 months is balanced)

- The Median Sales Price rose 4.7 percent to $356,002

- Days on Market rose 33.3 percent to 36 days, on average (median of 22 days, up 57.1 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 32.2 percent; Condo sales were down 36.4 percent & townhouse sales fell 33.1 percent

- Traditional sales declined 33.1 percent; foreclosure sales rose 45.0 percent; short sales were unchanged from last year

- Previously owned sales decreased 33.8 percent; new construction sales declined 18.3 percent