For Week Ending August 16, 2025

For Week Ending August 16, 2025

At present, 62% of Americans own a home, while 34% say they rent, according to a recent Gallup survey. Among non homeowners, 30% plan to purchase a home within the next five years, 23% plan to do so within the next ten years, and 45% have no plans to buy a home in the foreseeable future. Renters say the cost of homeownership, including a down payment, is the greatest barrier to purchasing a home.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 16:

- New Listings increased 9.2% to 1,466

- Pending Sales increased 6.8% to 1,007

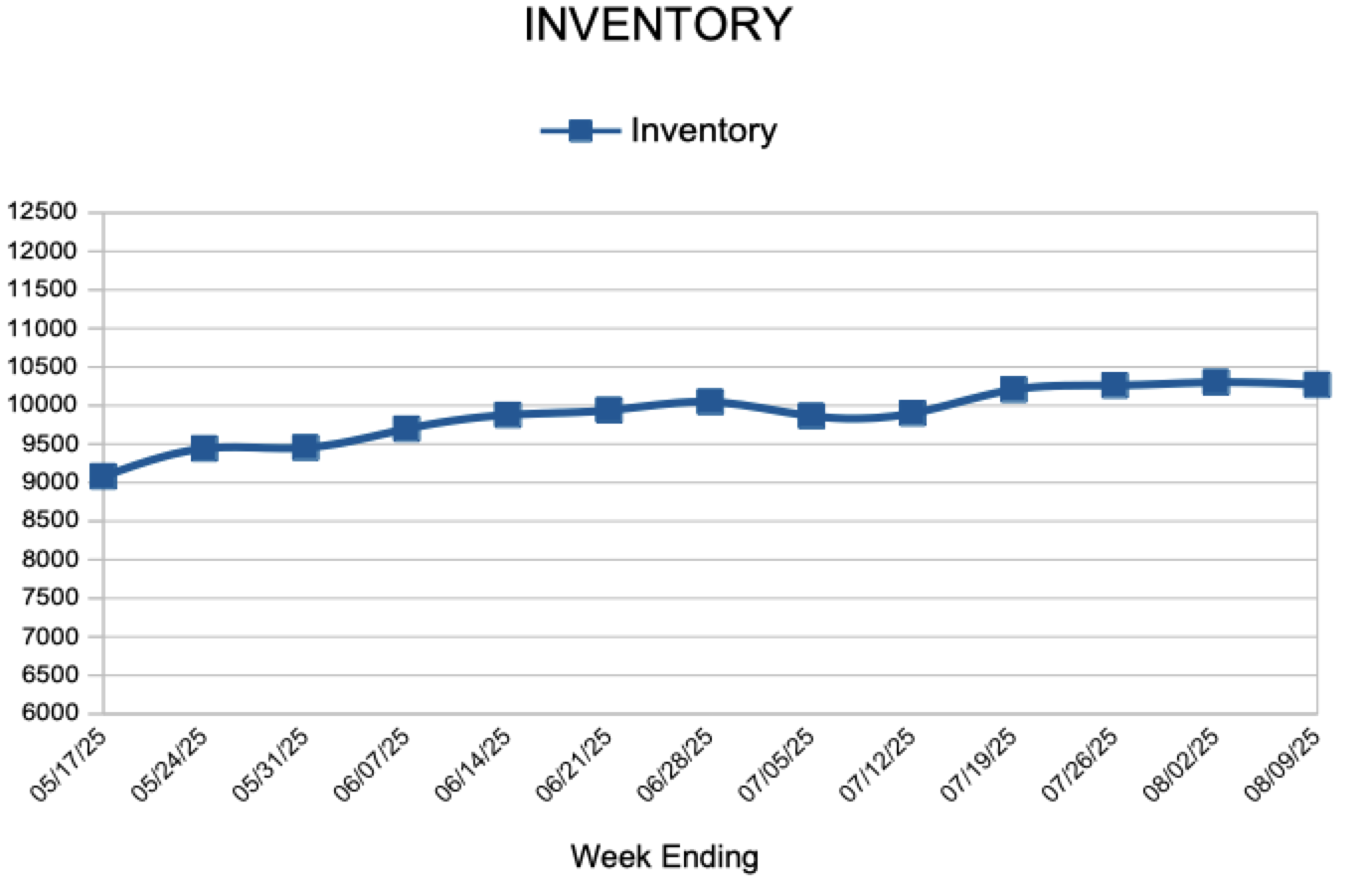

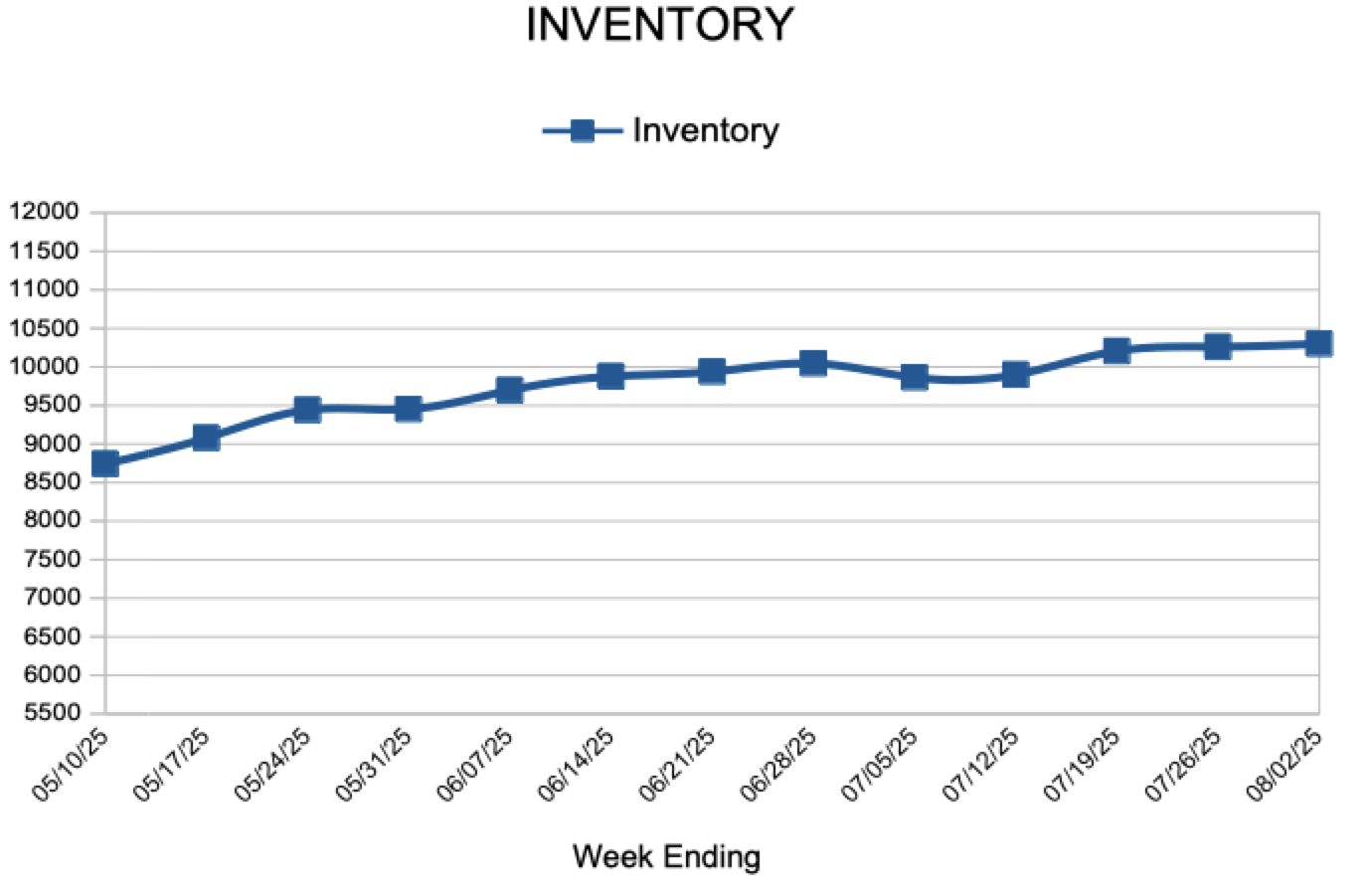

- Inventory increased 1.0% to 10,344

FOR THE MONTH OF JULY:

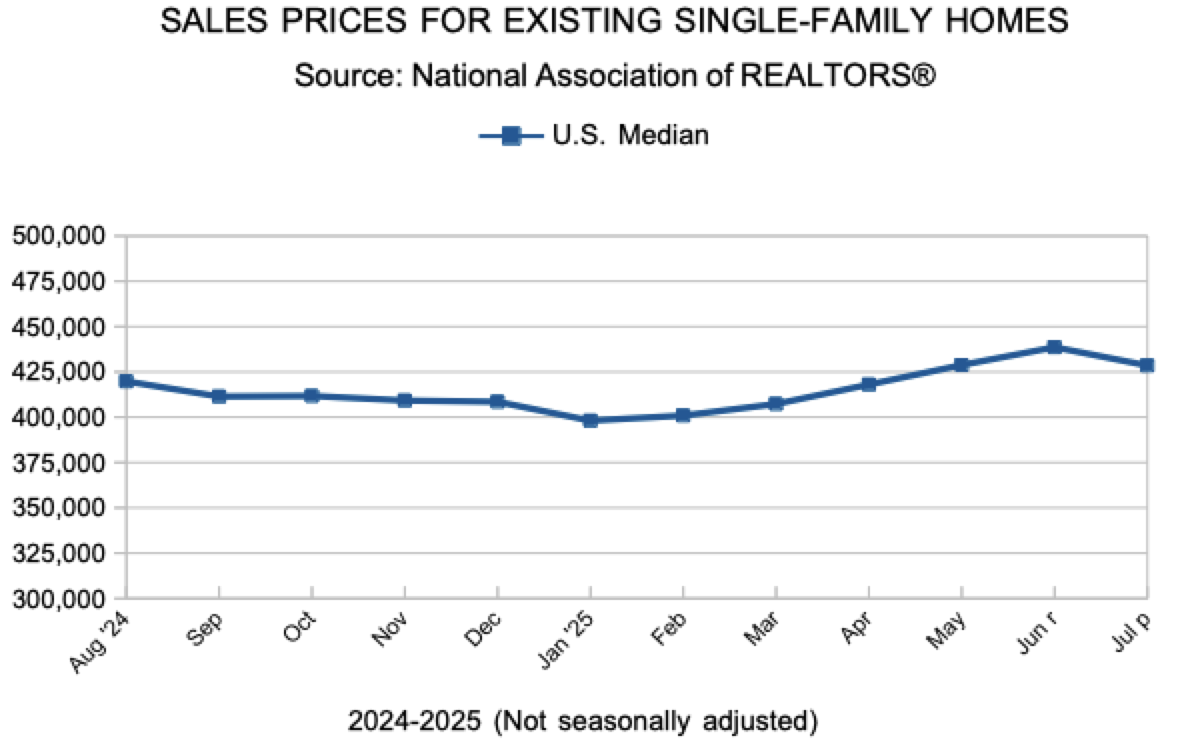

- Median Sales Price increased 2.6% to $395,000

- Days on Market increased 11.1% to 40

- Percent of Original List Price Received decreased 0.2% to 99.3%

- Months Supply of Homes For Sale remained flat at 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.