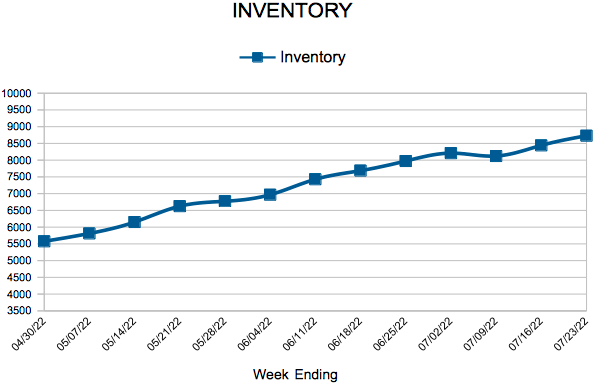

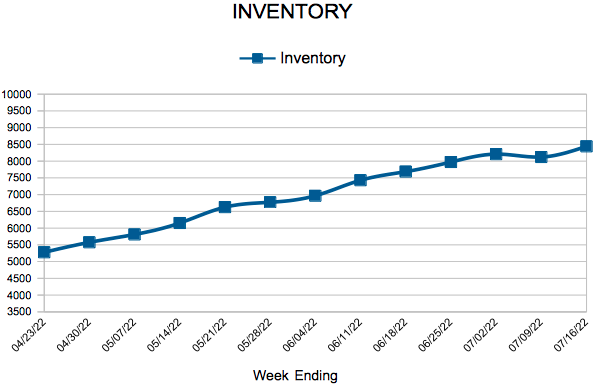

Inventory

Weekly Market Report

For Week Ending July 23, 2022

For Week Ending July 23, 2022

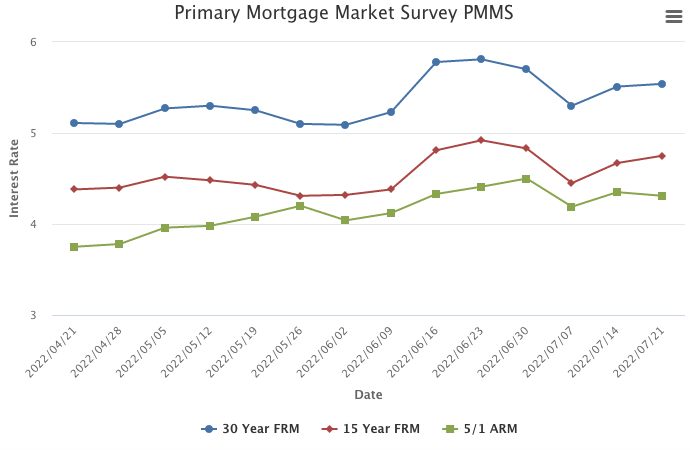

Mortgage applications declined for the fourth straight week, falling 1.8 percent from the previous week and marking the lowest level of activity since February 2000, according to the Mortgage Bankers Association. Increasing mortgage rates, escalating sales prices, and decades-high inflation continue to hinder affordability, putting homeownership on hold for many prospective buyers.

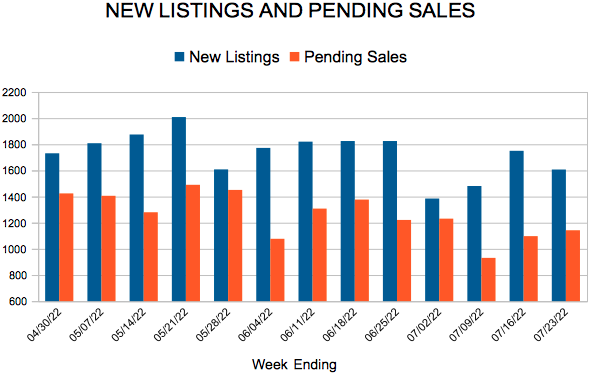

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 23:

- New Listings decreased 13.5% to 1,607

- Pending Sales decreased 25.1% to 1,142

- Inventory increased 9.7% to 8,729

FOR THE MONTH OF JUNE:

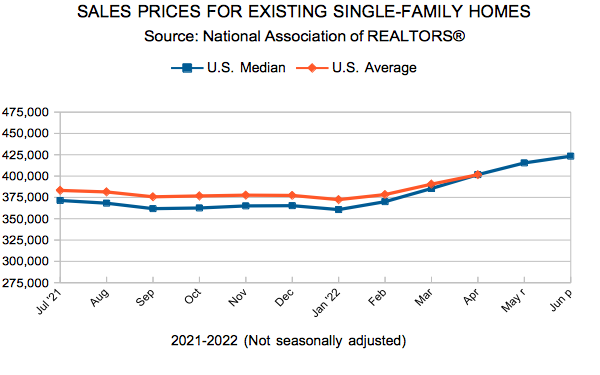

- Median Sales Price increased 8.6% to $380,000

- Days on Market increased 5.0% to 21

- Percent of Original List Price Received decreased 0.8% to 103.3%

- Months Supply of Homes For Sale increased 23.1% to 1.6

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Continue to Fluctuate

July 28, 2022

Purchase demand continues to tumble as the cumulative impact of higher rates, elevated home prices, increased recession risk, and declining consumer confidence take a toll on homebuyers. It’s clear that over the past two years, the combination of the pandemic, record low mortgage rates, and the opportunity to work remotely spurred greater demand. Now, as the market adjusts to a higher rate environment, we are seeing a period of deflated sales activity until the market normalizes.

Information provided by Freddie Mac.

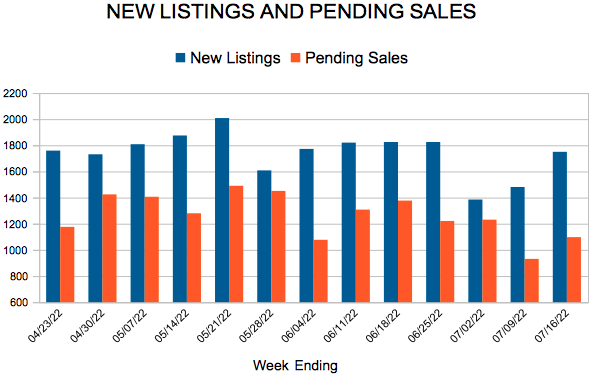

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending July 16, 2022

For Week Ending July 16, 2022

Increasing homeownership costs have led many prospective homebuyers to continue renting, adding additional pressure to an already highly competitive rental market. Rental vacancy rates have remained below 6% since Q3 2021, a 3-decade low, the U.S. Census Bureau reports. As demand continues to outpace supply, rents on new leases have surged 14.1% this year through June, according to Apartment List, a huge leap from the typical 2% – 3% annual rent increases before the pandemic.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 16:

- New Listings decreased 11.5% to 1,750

- Pending Sales decreased 24.8% to 1,097

- Inventory increased 10.1% to 8,441

FOR THE MONTH OF JUNE:

- Median Sales Price increased 8.6% to $380,000

- Days on Market increased 5.0% to 21

- Percent of Original List Price Received decreased 0.8% to 103.3%

- Months Supply of Homes For Sale increased 23.1% to 1.6

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

June Monthly Skinny Video

As existing home sales continue to soften nationwide, housing supply is slowly improving, with inventory up for the second straight month.

Mortgage Rates Continue to Inch Up

July 21, 2022

The housing market remains sluggish as mortgage rates inch up for a second consecutive week. Consumer concerns about rising rates, inflation and a potential recession are manifesting in softening demand. As a result of these factors, we expect house price appreciation to moderate noticeably.

Information provided by Freddie Mac.

Existing Home Sales

- « Previous Page

- 1

- …

- 75

- 76

- 77

- 78

- 79

- …

- 113

- Next Page »