For Week Ending October 19, 2024

For Week Ending October 19, 2024

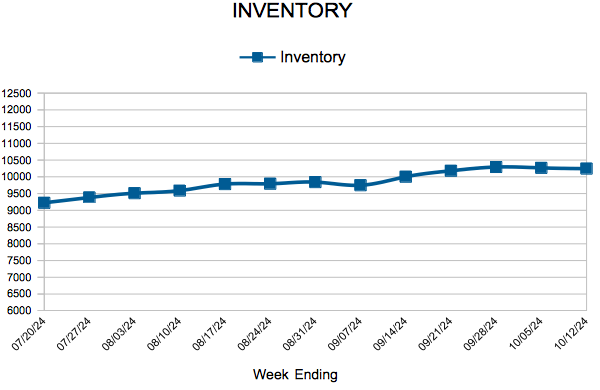

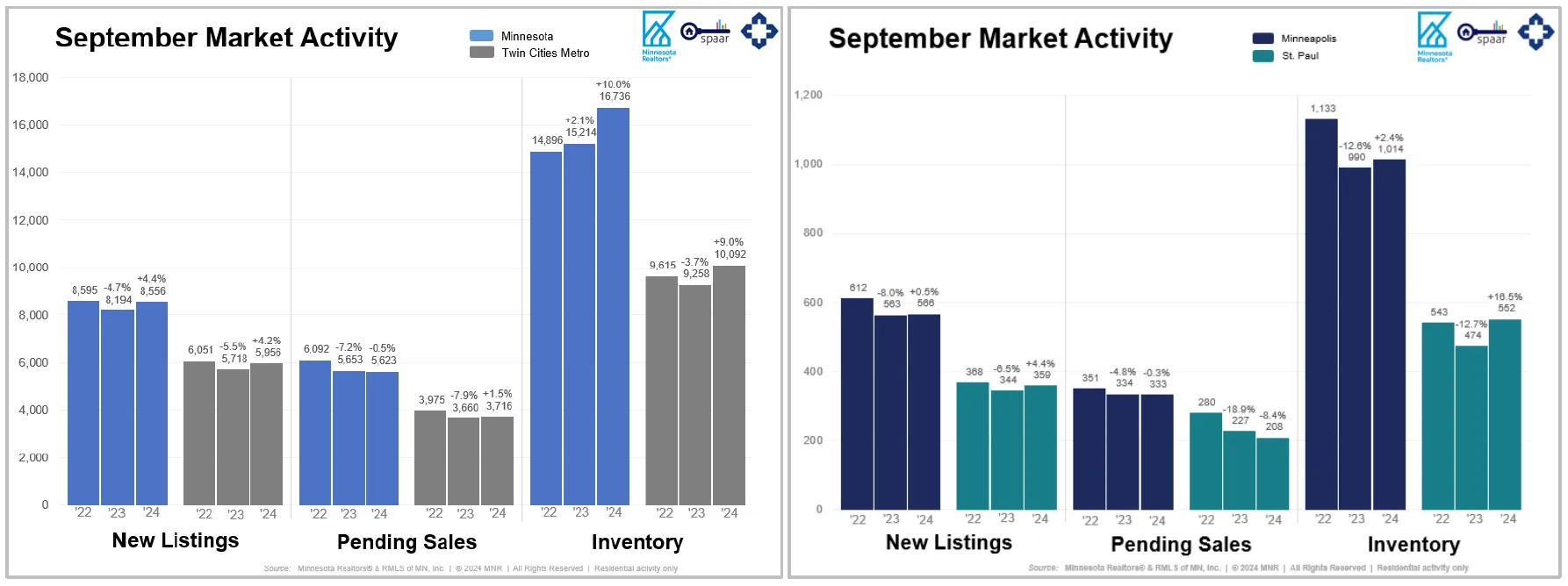

The number of homes for sale continues to grow nationwide, with Realtor.com reporting there were 34% more homes actively for sale in September compared to the same time last year. This marks the 11th consecutive month of annual growth, with supply now at the highest level since April 2020. Despite the upward trend, however, inventory is 23.2% lower compared to typical 2017 – 2019 levels.

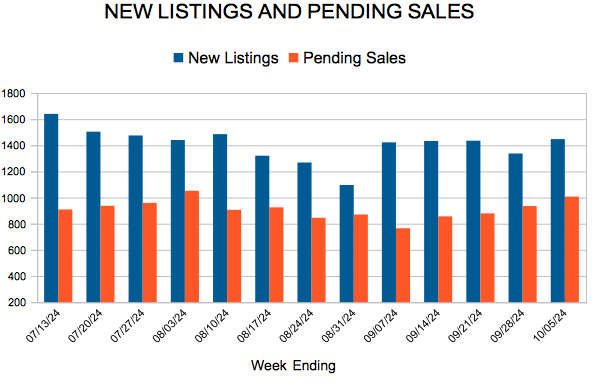

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 19:

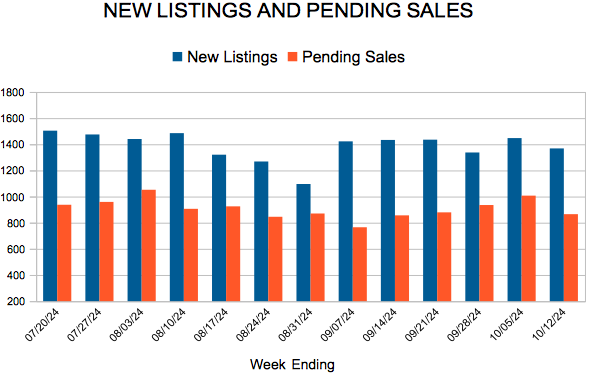

- New Listings increased 2.4% to 1,215

- Pending Sales increased 11.5% to 862

- Inventory increased 10.6% to 10,257

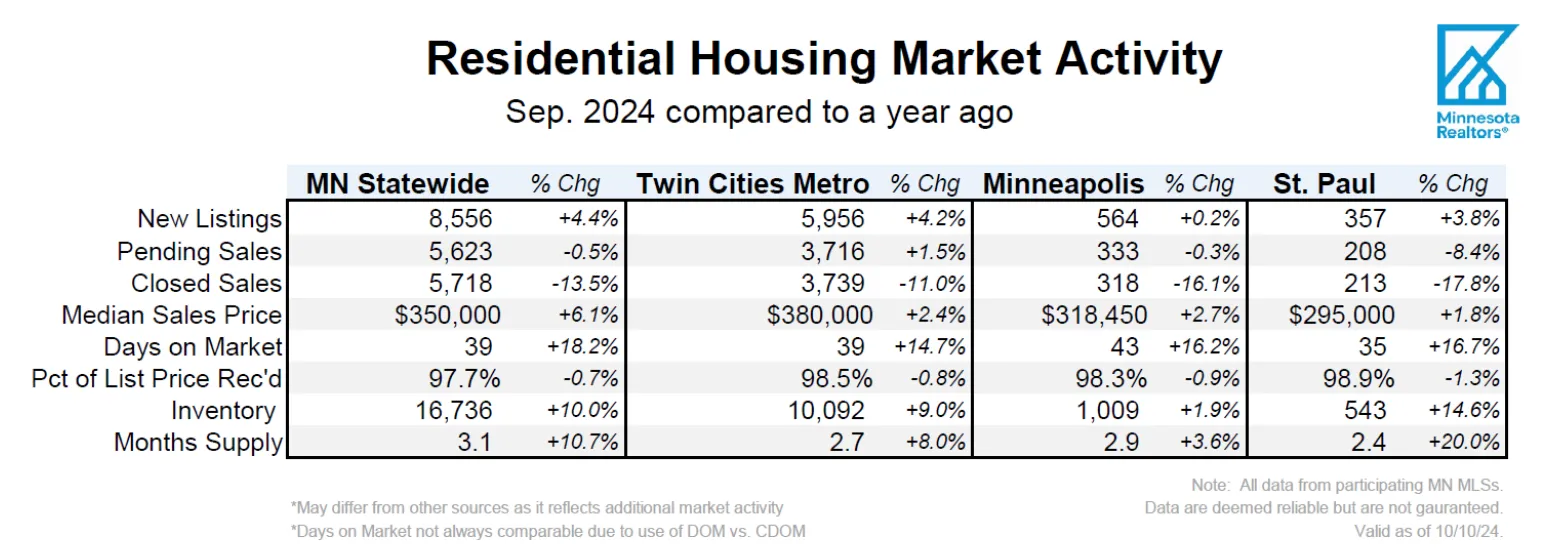

FOR THE MONTH OF SEPTEMBER:

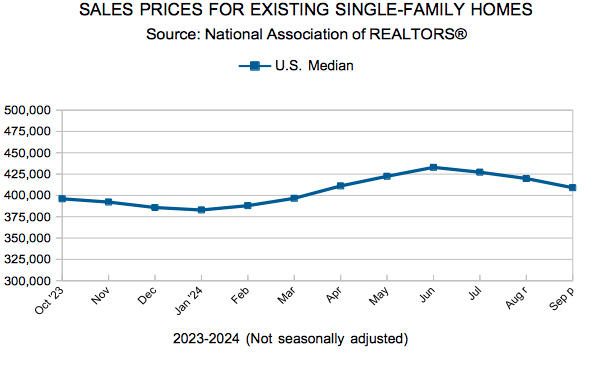

- Median Sales Price increased 2.4% to $380,000

- Days on Market increased 14.7% to 39

- Percent of Original List Price Received decreased 0.8% to 98.5%

- Months Supply of Homes For Sale increased 12.0% to 2.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.