May 23, 2024

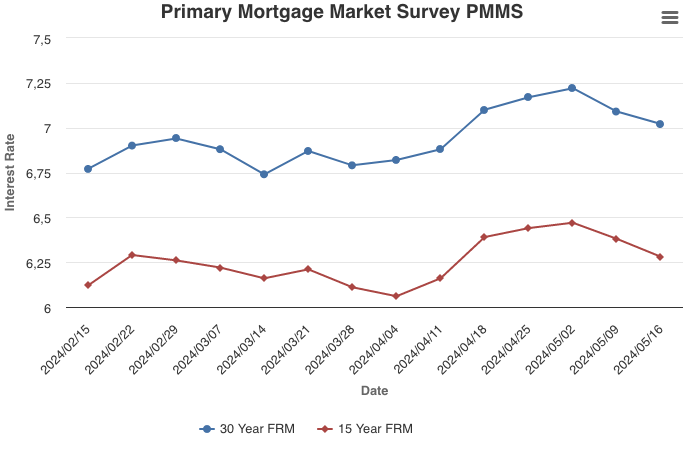

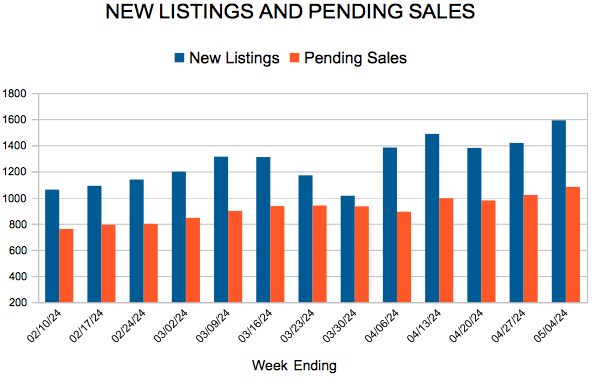

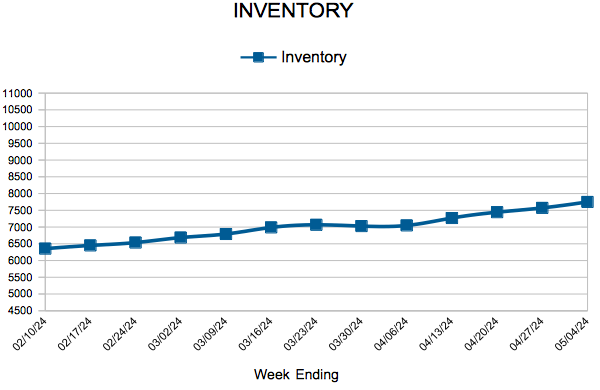

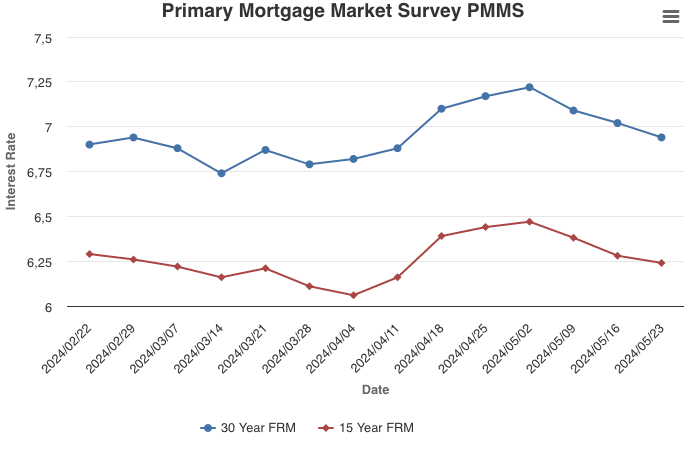

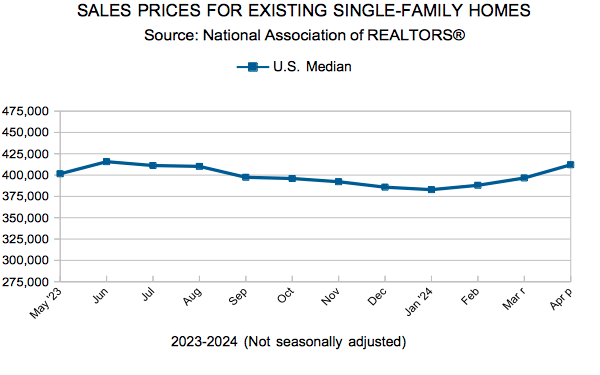

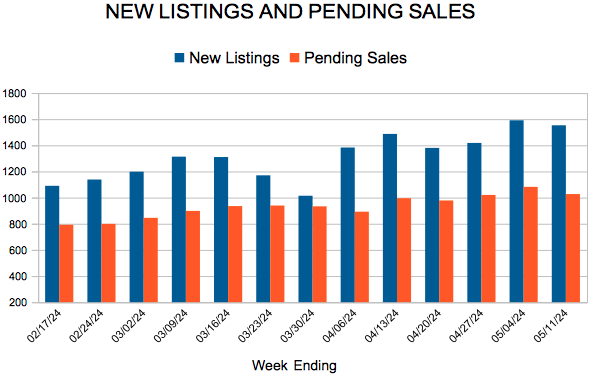

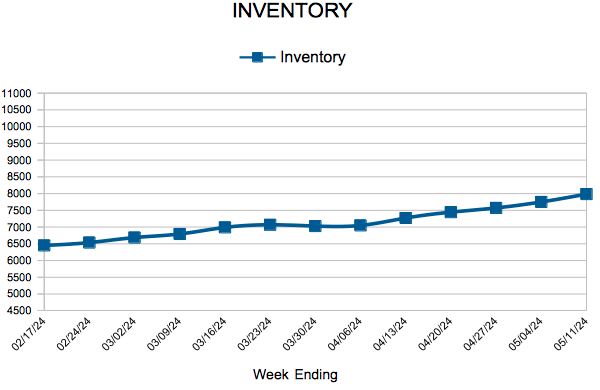

Spring homebuyers received an unexpected windfall this week, as mortgage rates fell below the seven percent threshold for the first time in over a month. Although this week’s data on previously owned home sales showed a decline, total inventory of both new and existing homes is up. Greater supply coupled with the recent downward trend in rates is an encouraging sign for the housing market.

Information provided by Freddie Mac.

For Week Ending May 11, 2024

For Week Ending May 11, 2024