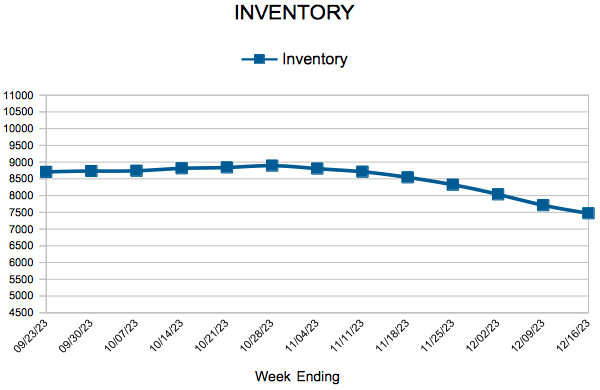

Inventory

Weekly Market Report

For Week Ending December 16, 2023

For Week Ending December 16, 2023

47.4% of mortgaged residential properties were considered equity-rich—having at least 50% equity in one’s home—in the third quarter of 2023, according to ATTOM’s Q3 2023 U.S. Home Equity and Underwater Report. This marks a decline from the second quarter, when 49.2% of mortgaged homes were considered equity rich. However, the portion of homes that were seriously underwater recently improved, increasing from one in 36 homes in the second quarter of 2023 to one in 40 homes in the third quarter, the lowest point in more than four years.

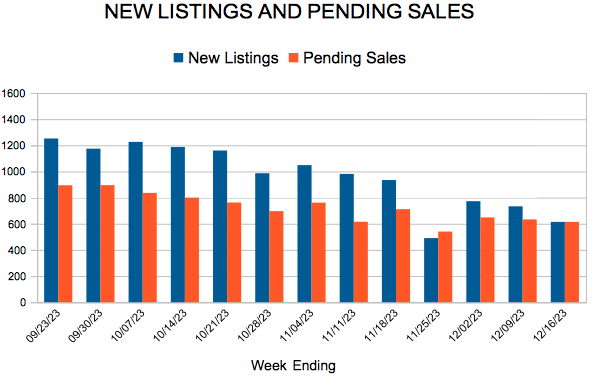

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 16:

- New Listings increased 11.0% to 614

- Pending Sales decreased 1.4% to 614

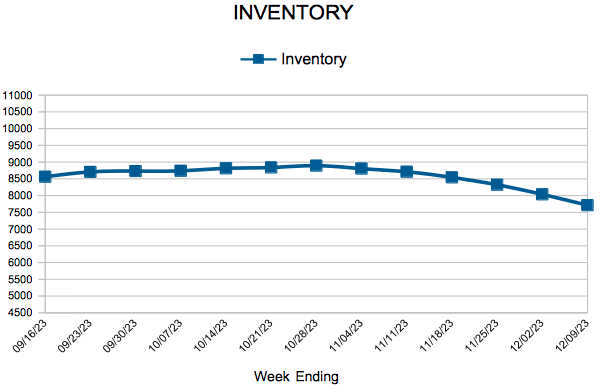

- Inventory decreased 5.0% to 7,470

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.2% to $362,600

- Days on Market remained flat at 40

- Percent of Original List Price Received increased 0.2% to 97.4%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

November Monthly Skinny Video

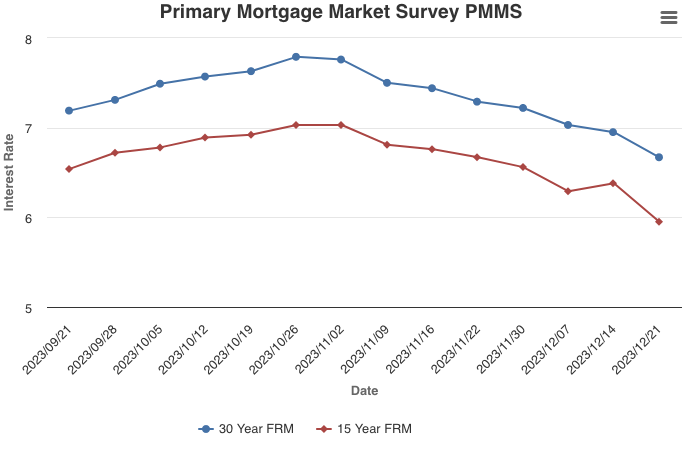

Mortgage Rates Continue Their Fall Below Seven Percent

December 21, 2023

The 30-year fixed-rate mortgage remained below seven percent for the second week in a row, a welcome downward trend after 17 consecutive weeks above seven percent. Lower rates are bringing potential homebuyers who were previously waiting on the sidelines back into the market and builders already are starting to feel the positive effects. A rise in homebuilder confidence, followed by new home construction reaching its highest level since May, signals a response to meet heightened demand as current inventory remains low.

Information provided by Freddie Mac.

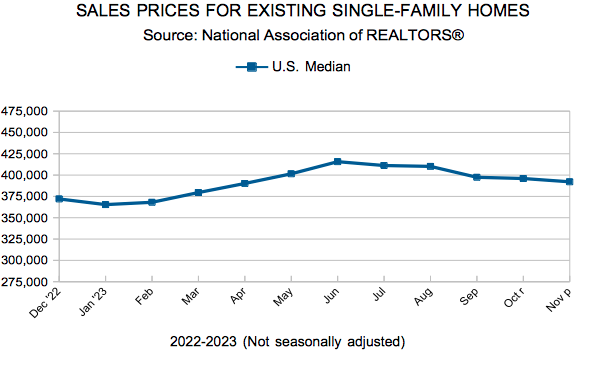

Existing Home Sales

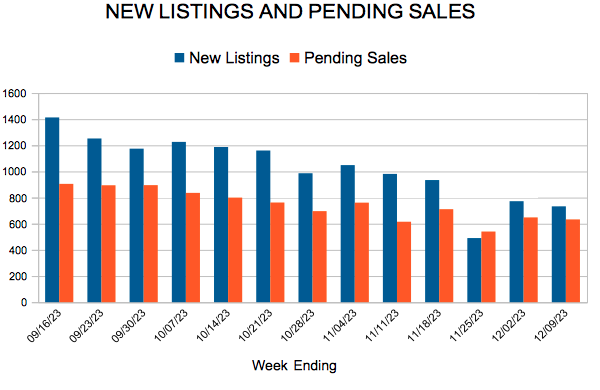

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending December 9, 2023

For Week Ending December 9, 2023

Nationally, the number of homes actively for sale remained mostly stable in November, climbing 0.7% year-over-year and 2.4% from the previous month, according to Realtor.com’s November 2023 Monthly Housing Market Trends Report. In addition, the number of newly listed homes for sale rose 7.5% year-over-year, snapping a 17-month streak in which listing activity declined, with an annual increase of 3% reported in the nation’s 50 largest metropolitan areas.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 9:

- New Listings increased 5.9% to 733

- Pending Sales increased 5.1% to 633

- Inventory decreased 4.7% to 7,712

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.2% to $362,600

- Days on Market remained flat at 40

- Percent of Original List Price Received increased 0.2% to 97.4%

- Months Supply of Homes For Sale increased 10.5% to 2.1

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

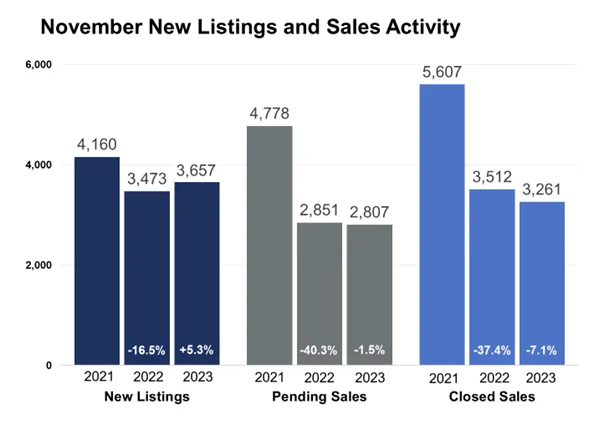

Sales flatten and prices remain higher, meanwhile new listings rise and rates ease

- The median sales price increased 2.0% to $362,000

- Signed purchase agreements fell 1.5%; new listings up 5.3%

- Market times flat at 40 days; months’ supply up 10.5% to 2.1 months

(Dec. 15, 2023) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, metro-wide home prices rose slightly in November. Sales activity was flat as mortgage rates softened slightly and new listings were up 5.3%.

Sellers, Buyers and Housing Supply

Rates have eased from over 8.0% in mid-October to around 7.0% by the end of November. While still elevated relative to the last 20 years, that figure is below its 50-year average. In addition to a low baseline comparison, that decline has helped the number of signed purchase agreements stabilize in November. And because sellers weren’t feeling quite as stuck in their homes, the dip in rates helped boost seller activity as some felt more confident about listing their homes.

Slightly lower rates could mean more buyers will qualify and write offers, and that fewer sellers will feel “locked in” to their mortgage rates. While that could mean more listing activity, it’s likely to be met with demand that’s been pent up for a while in the current affordability environment. Come spring market of 2024, that balance between supply and demand may offer key insights into how the year could play out.

Buyers are still feeling the triple punch of low inventory, rising prices and still relatively high mortgage rates. Comparing pending sales to closed sales can offer unique insights into demand trends. Pending sales were down just 1.5% from last November and are a better leading indicator than closings. Closed sales—reflecting contracts mostly signed in September and October when rates were higher—were down 7.1%. On the supply side, inventory levels across the Twin Cities fell 5.1% compared to last November. While buyers are still finding limited options in their searches, deals are still occurring with some persistence and flexibility. In addition, the lack of existing inventory has benefited the new home market.

More buyers are choosing to deploy cash instead of paying today’s interest rates. Cash sales so far this year are at their highest level since 2014. Overall, since both supply and demand levels are lower, the relative balance hasn’t changed as much as expected. “The recent dip in rates has definitely spurred some buyer interest,” said Jerry Moscowitz, President of Minneapolis Area REALTORS®. “Buyers choosing to wait until spring should expect heightened competition.”

Prices, Market Times and Negotiations

Though seemingly counter-intuitive, home prices continued their ascent, up a modest 2.0% from last November. Prices are rising for several reasons.

- Supply is short as homeowners with favorable rates remain in their homes.

- Today’s buyers tend to be better off financially and often use cash for higher-priced homes as higher rates have hindered the mid-end buyer, meaning activity is skewing toward the higher end of the market.

- Luxury activity continues to outperform along with new construction activity that also skews toward the upper end.

Negotiations held firm but have balanced out recently. Sellers accepted 97.4% of their asking price, which was up from 2022 but down from 2021. Half the homes went under contract in under 23 days compared to 25 days last year. That figure was once again improved from 2022 but softer compared to 2021.

Those two indicators reflect the relatively strong position in which sellers still find themselves, assuming they’re willing to sell. For November, the median home price rose 2.0% to $362,000. The year as a whole will likely show 1.0 to 2.0% price growth. “Buyers seem more sensitive to changes in rates than to the rate itself,” said Brianne Lawrence, President of the Saint Paul Area Association of REALTORS®. “While even a full point decrease in the rate hasn’t magically solved our affordability issues, it does lower monthly payments slightly.”

Affordability, Rates and Payments

Even as the Federal Reserve paused their rate hikes, the impact of mortgage rates on monthly payments is significant. Mortgage rates hit a 23-year high in October but retreated nearly a full point since. The Housing Affordability Index reached its lowest level since at least 2004. Given rates, incomes and prices at the time, affordability was better in 2006 than it is today. Using some assumptions around taxes and insurance, the local monthly payment on the median priced home stands at $2,650 so far this year compared to $1,600 in 2020.

Location & Property Type

Market activity always varies by area, price point and property type. New home sales rose while existing home sales fell. Condo sales rose more than single family and townhome units. Purchase agreements were down 13.0% in St. Paul but up 14.5% in Minneapolis. Cities farther out such as Cologne, Princeton, New Prague and North Oaks saw among the largest sales gains while Monticello, Isanti and Shorewood all had weaker demand.

November 2023 Housing Takeaways (compared to a year ago)

- Sellers listed 3,657 properties on the market, a 5.3% increase from last November

- Buyers signed 2,807 purchase agreements, down 1.5% (3,261 closed sales, down 7.1%)

- Inventory levels shrank 5.1% to 7,819 units

- Month’s Supply of Inventory rose 10.5% to 2.1 months (4-6 months is balanced)

- The Median Sales Price was up 2.0 percent to $362,000

- Days on Market was flat at 40 days, on average (median of 23 days, down 8.0%)

- Changes in Pending Sales activity varied by market segment

- Single family sales decreased 1.8%; condo sales were up 12.7%; townhouse sales fell 4.9%

- Traditional sales declined 2.1%; foreclosure sales rose 71.4% to 36; short sales fell 25.0% to 6

- Previously owned sales were down 3.7%; new construction sales increased 22.3%

- Sales under $500,000 decreased 5.3%; sales over $500,000 were up 16.7%

- « Previous Page

- 1

- …

- 40

- 41

- 42

- 43

- 44

- …

- 108

- Next Page »