September 28, 2023

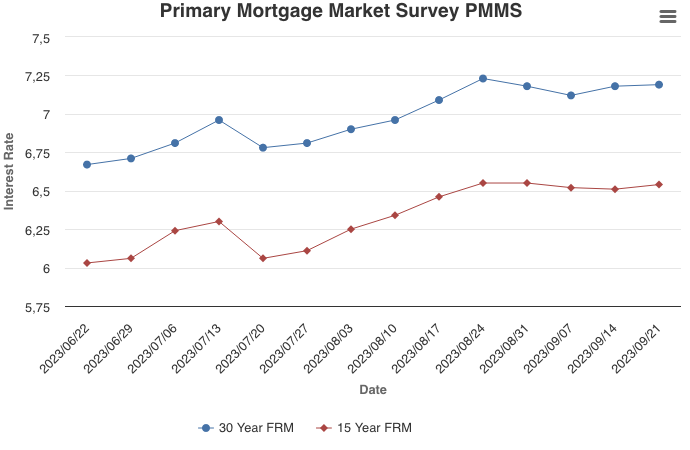

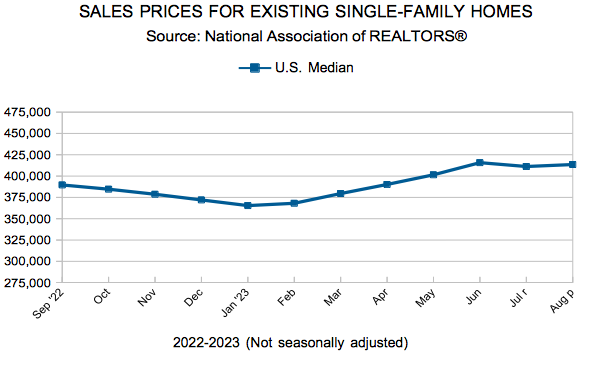

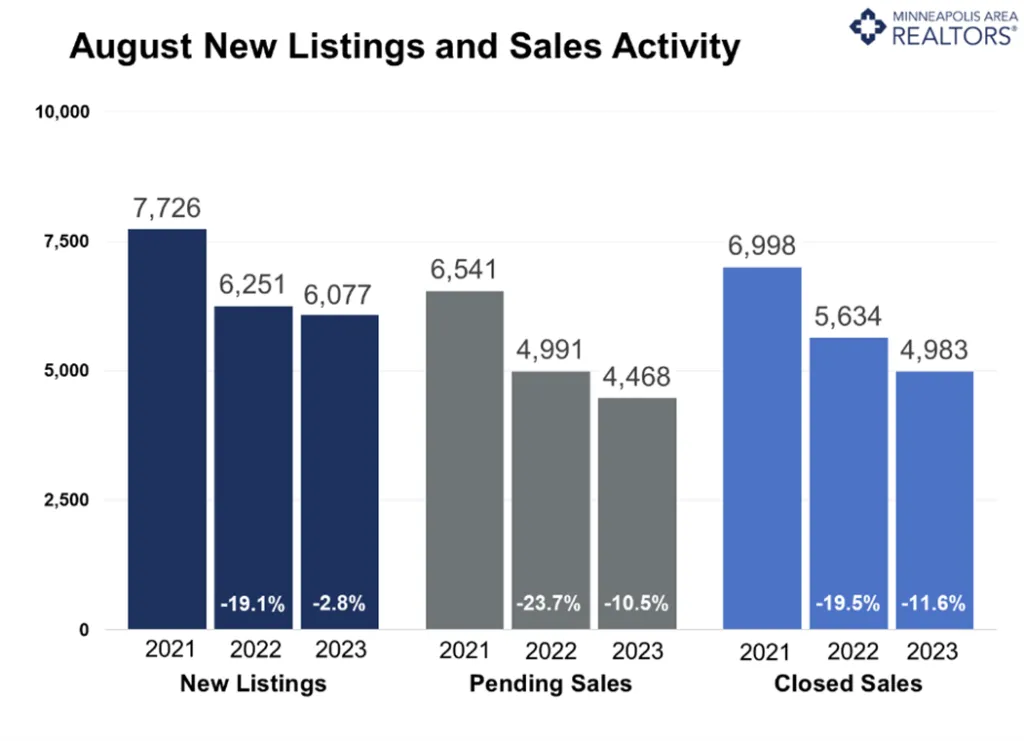

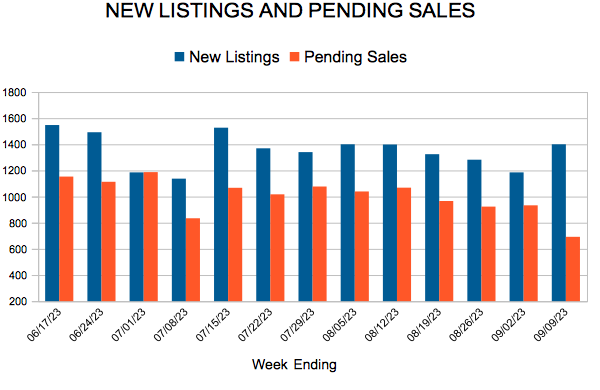

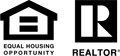

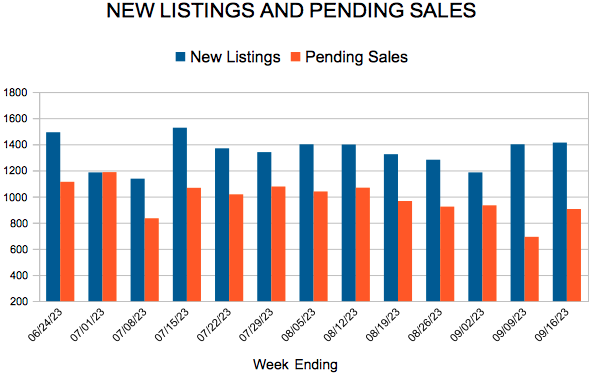

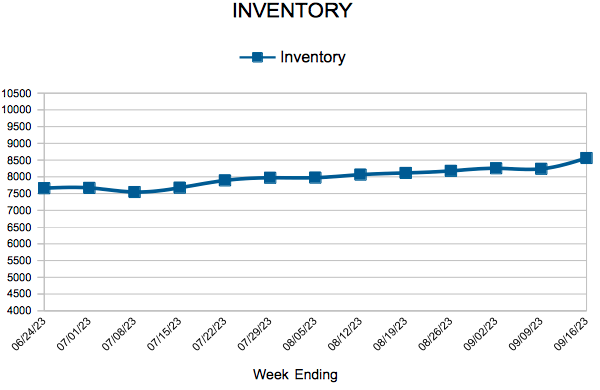

The 30-year fixed-rate mortgage has hit the highest level since the year 2000. However, unlike the turn of the millennium, house prices today are rising alongside mortgage rates, primarily due to low inventory. These headwinds are causing both buyers and sellers to hold out for better circumstances.

Information provided by Freddie Mac.

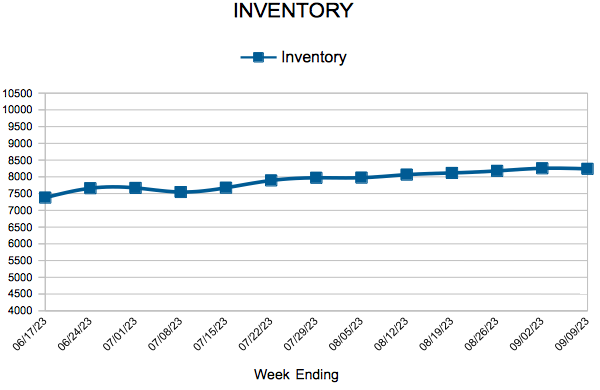

For Week Ending September 16, 2023

For Week Ending September 16, 2023