Weekly Market Report

For Week Ending October 15, 2022

For Week Ending October 15, 2022

Median national rents fell slightly to $1,759 in September, marking the second consecutive month rents have dropped, according to a recent report from Realtor.com. Although median rents remain 7.8% higher than a year ago, it represents the smallest year-over-year increase and the slowest annual rate of growth since June 2021, suggesting the rental market may be cooling after the record-breaking pace of the last two years.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 15:

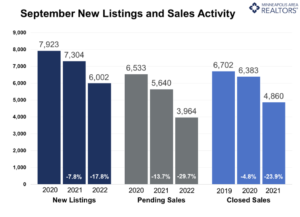

- New Listings decreased 14.0% to 1,266

- Pending Sales decreased 37.3% to 835

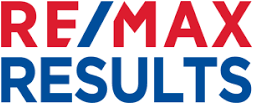

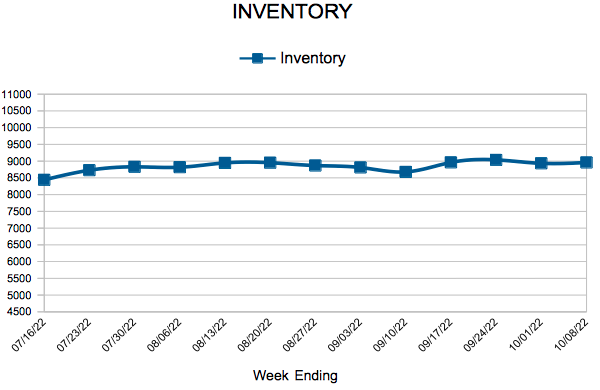

- Inventory increased 4.0% to 9,071

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 6.3% to $362,050

- Days on Market increased 39.1% to 32

- Percent of Original List Price Received decreased 2.3% to 98.9%

- Months Supply of Homes For Sale increased 18.8% to 1.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

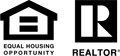

Mortgage Rates Slow Their Upward Trajectory

October 20, 2022

The 30-year fixed-rate mortgage continues to remain just shy of seven percent and is adversely impacting the housing market in the form of declining demand. Additionally, homebuilder confidence has dropped to half what it was just six months ago and construction, particularly single-family residential construction, continues to slow down.

Information provided by Freddie Mac.

Existing Home Sales

Rates push sales down further as home prices continue to grow

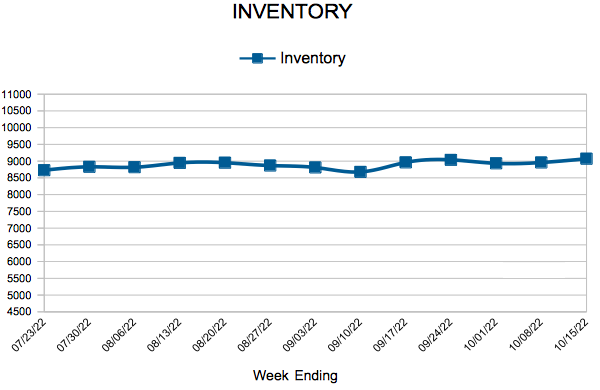

- Buyer activity dropped 29.7 percent for pending sales and 23.9 percent for closings

- Median sales price of Twin Cities homes rose 6.3 percent to $362,000

- Sellers received 98.9 percent of their original list price, on average

(September 16, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, pending sales were down by over a quarter in September compared to last year. Sellers also accepted a smaller share of their asking price as their listings took longer to sell. Despite this, the homes that are selling are transacting at higher price points than last year.

Sales & Listings

Higher mortgage rates and historically strong demand in 2021 have pushed closed home sales down by double digits for four straight months. Last month had 3,969 signed purchase agreements, 29.6 percent short of 2021 levels and the lowest September figure since 2014. As the hyper-demand from the buying frenzy of the past two years wanes, those who remain in the market have regained some leverage.

“Our buyers can pause and breathe a bit— they no longer feel compelled to skip inspection or go way over list price,” according to Denise Mazone, President of Minneapolis Area REALTORS®. “But some sellers think they’re in the same position they were in a year ago, while some buyers think they’re going to get deals like it’s 2010. As usual, the truth is somewhere in the middle.”

Seller activity was down as many sellers remain apprehensive about also becoming buyers. Softening demand has meant homes linger on the market a bit longer—31 days on average or 34.8 percent longer than last September. Fewer homeowners are willing to relinquish their interest rates and list their homes. Sellers listed 6,002 properties on the market, 17.8 percent fewer than this time in 2021. Those that did list their homes tended to accept a smaller share of their asking price. But, they get to purchase in a less frenzied market.

Inventory & Home Prices

The median home price in the Twin Cities increased by 6.3 percent to $362,000. While still up, the growth is down from double-digit price gains seen in 2020 and 2021 and is the second smallest increase in two years. Although the rate of price growth is slowing, prices remain firm and resilient in the face of declining buyer activity. Housing supply levels remain tight, despite the recent market shifts. And, the softening in demand has been accompanied by a decline in new listings, so both sides have downshifted in tandem without creating the sort of asymmetry or imbalance that could abruptly shake up prices.

“Some might see a disconnect between lower demand and strong pricing right now.” said Mark Mason, President of the Saint Paul Area Association of REALTORS®. “While prices remain firm and resilient, the rebalancing we’ve seen means sellers shouldn’t expect dozens of offers at 10 percent or more above list price on the same day they list. Buyers may feel like they have a greater likelihood of success.”

September ended with 9,002 homes for sale, only 3 more units than last year. The momentum has been shifting back towards a more balanced marketplace (4-6 months of supply), but buyers should understand we are still in a seller’s market. Month’s supply of inventory rose 18.8 percent to 1.9 months.

Location & Property Type

Market activity varies by area, price point and property type. New home sales fell 0.2 percent while existing home sales were down 24.4 percent. Single family sales fell 22.1 percent, condo sales declined 19.8 percent and townhome sales were down 26.3 percent. Sales in Minneapolis decreased 14.7 percent while Saint Paul sales fell only 10.1 percent. Cities like Pine City, Corcoran, Rush City and Delano saw the largest sales gains while Clear Lake, Centerville, St. Anthony and River Falls all had lower demand than last year.

September 2022 Housing Takeaways (compared to a year ago)

- Sellers listed 6,002 properties on the market, a 17.8 percent decrease from last September

- Buyers signed 3,964 purchase agreements, down 29.7 percent (4,860 closed sales, down 23.9 percent)

- Inventory levels were flat at 9,002 units

- Month’s Supply of Inventory rose 18.8 percent to 1.9 months (4-6 months is balanced)

- The Median Sales Price rose 6.3 percent to $362,000

- Days on Market rose 34.8 percent to 31 days, on average (median of 19 days, up 58.3 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 22.1 percent; Condo sales were down 19.8 percent & townhouse sales fell 26.3 percent

- Traditional sales declined 23.1 percent; foreclosure sales rose 60.9 percent; short sales were up 50.0 percent (from 2 to 3)

- Previously owned sales decreased 24.4 percent; new construction sales declined 0.2 percent

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending October 8, 2022

For Week Ending October 8, 2022

Mortgage application activity nationwide recently dropped to its lowest pace in 25 years, according to the Mortgage Bankers Association (MBA), with purchase and refinance applications down considerably compared to this time last year, when mortgage rates were hovering around 3%. The sharp increase in rates has caused mortgage applications for purchase to decline 39% compared to the same week a year ago.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 8:

- New Listings decreased 16.8% to 1,260

- Pending Sales decreased 40.2% to 812

- Inventory increased 1.7% to 8,959

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 6.3% to $362,100

- Days on Market increased 39.1% to 32

- Percent of Original List Price Received decreased 2.3% to 98.9%

- Months Supply of Homes For Sale increased 18.8% to 1.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

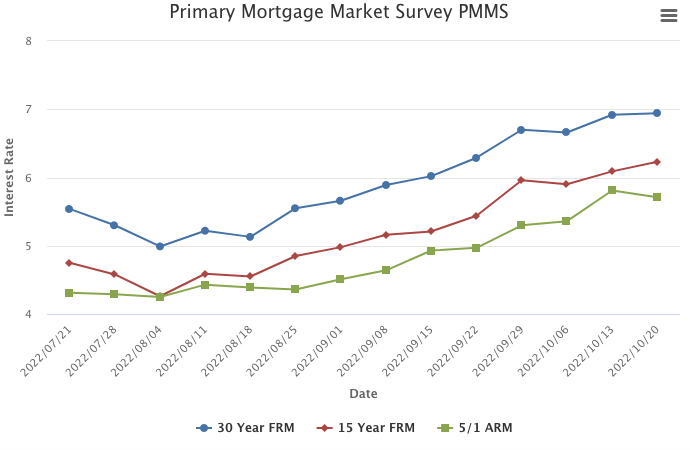

Mortgage Rates Resume Their Climb

October 13, 2022

Rates resumed their record-setting climb this week, with the 30-year fixed-rate mortgage reaching its highest level since April of 2002. We continue to see a tale of two economies in the data: strong job and wage growth are keeping consumers’ balance sheets positive, while lingering inflation, recession fears and housing affordability are driving housing demand down precipitously. The next several months will undoubtedly be important for the economy and the housing market.

Information provided by Freddie Mac.

August Monthly Skinny Video

- « Previous Page

- 1

- …

- 68

- 69

- 70

- 71

- 72

- …

- 108

- Next Page »