Weekly Market Report

For Week Ending February 5, 2022

For Week Ending February 5, 2022

Despite falling temperatures and a surge in COVID-19 cases across the country, the U.S. real estate market remains active, with homes selling in record time due to robust buyer demand and a shortage of housing options. With inventory down 28.4% compared to a year ago, the average home spent just 61 days on the market in January, a 14% drop from last year and the fastest pace of any January on record, according to Realtor.com’s monthly housing report.

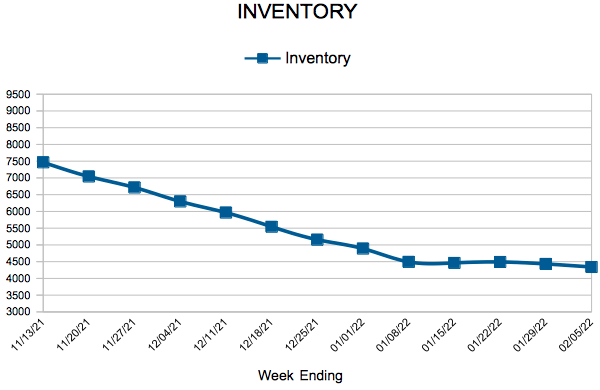

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 5:

- New Listings decreased 15.3% to 1,018

- Pending Sales decreased 19.1% to 883

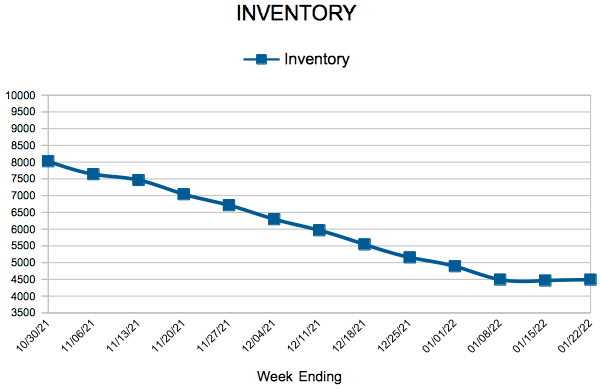

- Inventory decreased 21.2% to 4,341

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 8.0% to $331,420

- Days on Market decreased 12.8% to 34

- Percent of Original List Price Received decreased 0.2% to 99.5%

- Months Supply of Homes For Sale decreased 18.2% to 0.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

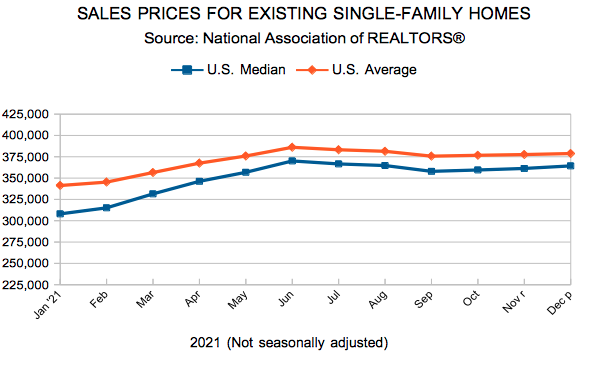

Existing Home Sales

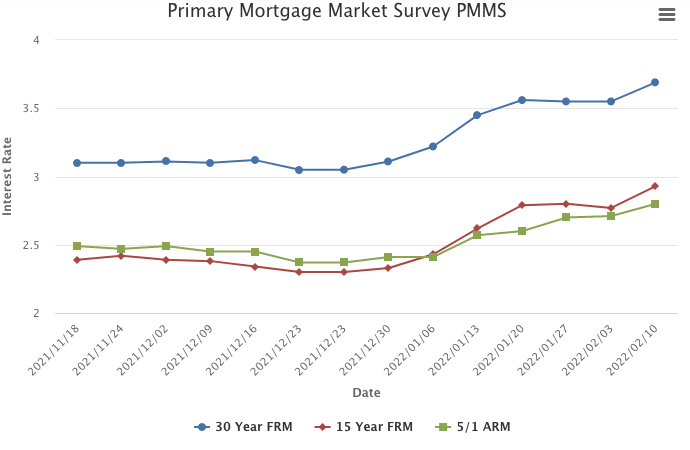

Mortgage Rates Jump

February 10, 2022

The normalization of the economy continues as mortgage rates jumped to the highest level since the emergence of the pandemic. Rate increases are expected to continue due to a strong labor market and high inflation, which likely will have an adverse impact on homebuyer demand.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending January 29, 2022

For Week Ending January 29, 2022

Home seller profits increased in more than 90% of housing markets last year, the highest level since 2008, according to ATTOM Data Solutions’ Year-End 2021 U.S. Home Sales Report. On average, sellers saw a profit of $94,092 on a typical median-priced home in 2021, an increase of 45% from 2020 and up 71% from 2019. Sellers saw a 45.3% return on investment compared to the original purchase price, with the highest profits found among sellers in western states.

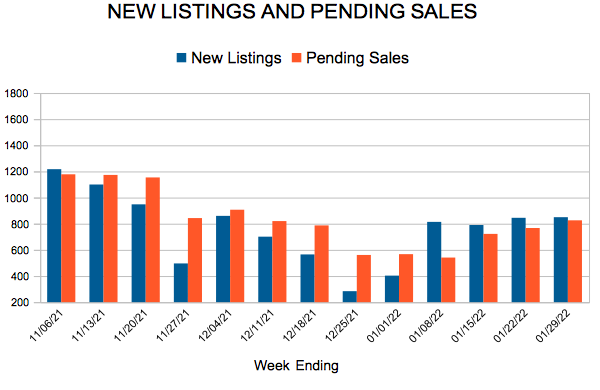

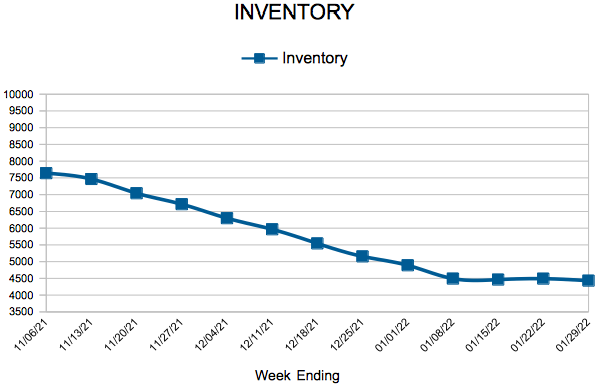

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 29:

- New Listings decreased 17.8% to 850

- Pending Sales decreased 12.8% to 826

- Inventory decreased 21.2% to 4,432

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 7.9% to $331,270

- Days on Market decreased 12.8% to 34

- Percent of Original List Price Received decreased 0.2% to 99.5%

- Months Supply of Homes For Sale decreased 18.2% to 0.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

New Listings and Pending Sales

Inventory

Weeklly Market Report

For Week Ending January 22, 2022

For Week Ending January 22, 2022

With a shortage of options and bidding wars reaching an all-time high last year, an increasing number of buyers waived financing, appraisal, and inspection contingencies in hopes of making their offers more attractive to sellers. That number has been trending downward in recent months, according to the National Association of REALTORS® December 2021 REALTORS® Confidence Index Survey, which reports that while 79% of buyers waived a contract contingency in June 2021, only 60% of buyers did so in December.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 22:

- New Listings decreased 10.9% to 845

- Pending Sales decreased 15.6% to 767

- Inventory decreased 21.5% to 4,491

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 7.9% to $331,100

- Days on Market decreased 12.8% to 34

- Percent of Original List Price Received decreased 0.2% to 99.5%

- Months Supply of Homes For Sale decreased 27.3% to 0.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 84

- 85

- 86

- 87

- 88

- …

- 108

- Next Page »