Inventory

Weekly Market Report

For Week Ending October 8, 2022

For Week Ending October 8, 2022

Mortgage application activity nationwide recently dropped to its lowest pace in 25 years, according to the Mortgage Bankers Association (MBA), with purchase and refinance applications down considerably compared to this time last year, when mortgage rates were hovering around 3%. The sharp increase in rates has caused mortgage applications for purchase to decline 39% compared to the same week a year ago.

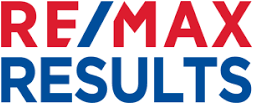

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 8:

- New Listings decreased 16.8% to 1,260

- Pending Sales decreased 40.2% to 812

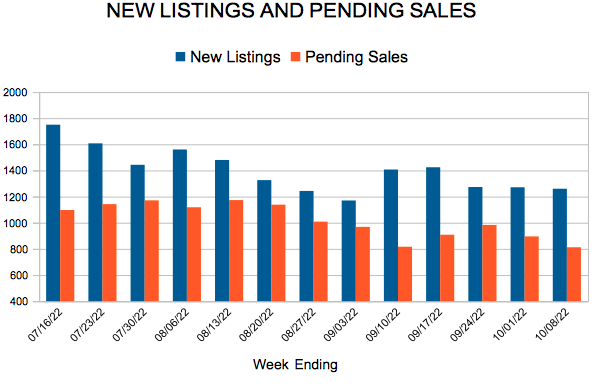

- Inventory increased 1.7% to 8,959

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 6.3% to $362,100

- Days on Market increased 39.1% to 32

- Percent of Original List Price Received decreased 2.3% to 98.9%

- Months Supply of Homes For Sale increased 18.8% to 1.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

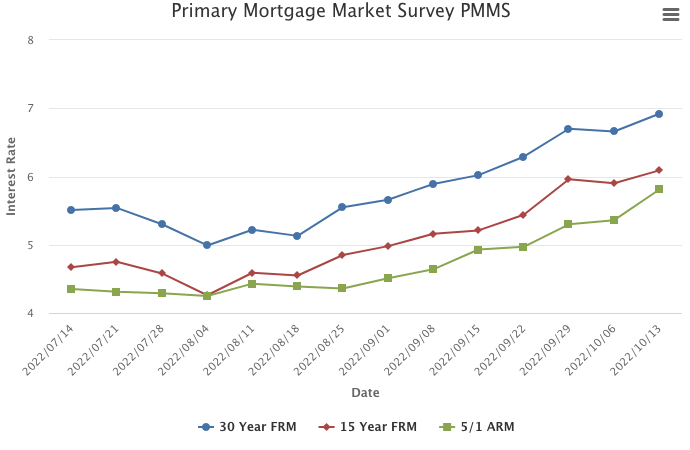

Mortgage Rates Resume Their Climb

October 13, 2022

Rates resumed their record-setting climb this week, with the 30-year fixed-rate mortgage reaching its highest level since April of 2002. We continue to see a tale of two economies in the data: strong job and wage growth are keeping consumers’ balance sheets positive, while lingering inflation, recession fears and housing affordability are driving housing demand down precipitously. The next several months will undoubtedly be important for the economy and the housing market.

Information provided by Freddie Mac.

August Monthly Skinny Video

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending October 1, 2022

For Week Ending October 1, 2022

U.S. home prices are falling at the fastest rate since January 2009, according to recent data from Black Knight, as shifting market conditions have led many sellers to lower their asking price. Nationally, median home prices fell by 0.98% from July to August, marking the second consecutive month prices have declined. Although home prices are down 2% from their peak in June, they remain up 12.1 % compared to the same period last year.

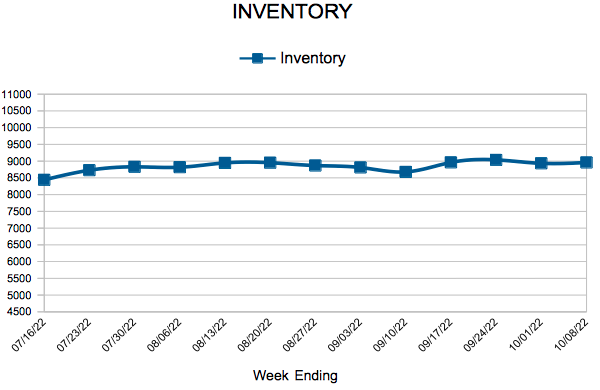

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 1:

- New Listings decreased 20.0% to 1,271

- Pending Sales decreased 36.5% to 895

- Inventory decreased 0.8% to 8,934

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 5.7% to $369,900

- Days on Market increased 22.7% to 27

- Percent of Original List Price Received decreased 2.4% to 99.9%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

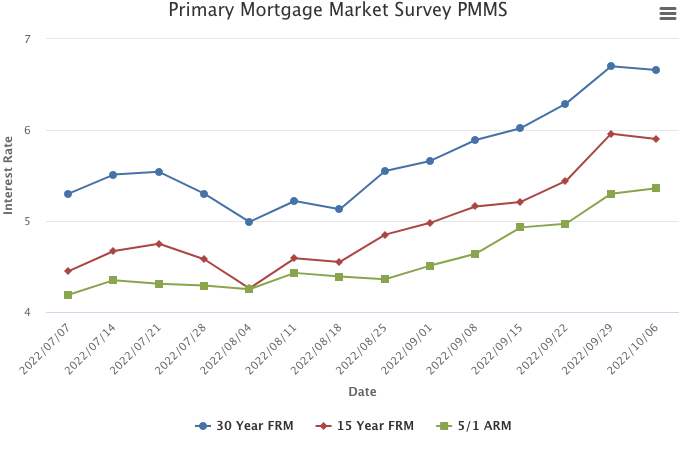

Mortgage Rates Decrease Slightly

October 6, 2022

Mortgage rates decreased slightly this week due to ongoing economic uncertainty. However, rates remain quite high compared to just one year ago, meaning housing continues to be more expensive for potential homebuyers.

Information provided by Freddie Mac.

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 71

- 72

- 73

- 74

- 75

- …

- 113

- Next Page »